It’s critically important that every health plan monitor its claims data to determine whether claims data errors are allowing your PBM to overcharge for drugs and misrepresent whether the PBM is satisfying contract pricing guarantees.

It’s critically important that every health plan monitor its claims data to determine whether claims data errors are allowing your PBM to overcharge for drugs and misrepresent whether the PBM is satisfying contract pricing guarantees.

As you read through our example of a claims data error – and the impact that it had – you’ll understand why. Just note as you’re doing so: Don’t get flummoxed by the math and stop reading. We promise you’ll understand how to protect your plan if you read to the end of this Alert.

An Example of a Claims Data Error

Salex is a cream to treat psoriasis, among other skin problems. The AWP for a pound of Salex is $668.20. A retail pharmacy’s U&C might be, say, $700. Thus, assuming your PBM reimburses retail pharmacies based on “the lowest of AWP-15% or U&C,” your PBM will reimburse a pharmacy for 1 tube (or “unit”) of Salex based on AWP-15%, and pay the pharmacy – and invoice you – 15% less than $668.20, or $567.87.

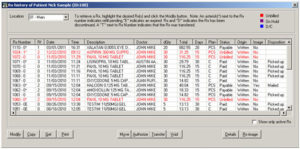

But what if the pharmacy errs and enters the wrong data into its transmittal to your PBM? Since Salex is purchased by the pound, and there are 454 grams of Salex in a pound, rather than reporting that it dispensed 1 “unit” of Salex, the pharmacy may report that it dispensed 454 units. While the AWP of 1 unit of Salex is $668.20, the AWP of 454 units is $303,362.80.

If your PBM has not programmed its adjudication system to catch and correct this type of quantity error, the PBM’s system will now inaccurately conclude that “the lowest of AWP-15% and U&C” is the U&C. As a result, rather than reimbursing the pharmacy – and invoicing you – $567.87 for the single Salex tube, your PBM will reimburse the pharmacy – and invoice you – $700. That means your PBM will overcharge you for a single tube of Salex $132.02 ($700 – $567.87).

But that will only be the beginning of your problems! At the end of the year, your PBM will also inaccurately report whether it satisfied your contract guarantees. Here’s why:

To keep things simple, let’s assume that your contract requires your PBM to provide your health plan with an average annual discount guarantee for all retail brands of AWP-15%. Had the PBM’s adjudication system corrected the pharmacy’s error when the pharmacy reported it dispensed 454 units – and properly invoiced your health plan for 1 unit – at an AWP discount of AWP-15%, the PBM would average that discount into its calculation of its average annual discounts on all retail brand drugs. And assuming its average cost for all other Brand Drugs was AWP-15%, the PBM would accurately report that it satisfied this contract guarantee.

However, given the PBM’s failure to catch and correct the retail pharmacy’s error, the PBM’s system will now inaccurately calculate that 454 units of Salex – at an AWP of $668.20 per unit – was dispensed at a total AWP cost of $303,362.80. And the PBM will compare that total AWP to the price it invoiced your plan, namely $700. Therefore, the PBM will claim that it purportedly provided a discount on this one tube of Salex of AWP – 99.81%. And that is the discount that the PBM will average into all other Brand Drug discounts that it provided to determine if it satisfied its annual Brand Drug guarantee.

Imagine that! The PBM failed to detect and correct the quantity error, then overcharged your plan by $132.02, and now is able to claim that it provided a discount of AWP-99.81%!

Of course, the reality is quite different: If the actual AWP of 1 unit was $668.20, and the PBM inaccurately invoiced your health plan $700, the PBM charged your health plan AWP + 1.7%, and that’s the figure that should be averaged into the rest of its Brand Drug AWP discounts.

What’s the impact in dollars of the PBM’s inaccurate calculation? In calculating whether it satisfied its guarantees, the PBM has wrongly credited itself with $257,158.38! ($303,362.80 x .85 – $700.00)

Does it matter if the PBM commits only a few such errors among hundreds of thousands of dispensed prescriptions? Believe it or not, it definitely does.

In fact, just a few such quantity errors – if you don’t catch them during the year – enable your PBM to overcharge you thousands of dollars. Even more important, just a few such errors allow your PBM to totally distort whether it satisfied your contract guarantees.

For example, in a recent audit of a plan, we found 32 such errors, resulting in total overcharges of $6,062, enabling the PBM to “pick up’ or wrongly credit itself in calculating its guarantee satisfaction with a total of $8.1 million. That, in turn, enabled the PBM to inaccurately report that it had provided an average annual guarantee for brand drugs of AWP-27%, when in fact it had only provided an average annual guarantee of AWP-16.2%. In other words, the PBM could grossly overstate its guarantee performance.

Take-Aways

Even if you don’t understand all the above math, here are the obvious take-aways from our discussion:

First: Make sure your PBM contract contains the following critical contract provisions:

- Your contract must require your PBM to correct all retail pharmacy errors before invoicing your health plan

- Your contract must also state that if your PBM fails to do so, it must reimburse your plan for any overcharges that resulted from errors

- Also, your contract must make clear that your auditor has the right to correct or exclude quantity errors when determining whether your PBM satisfied its contract pricing guarantees

Second: When you conduct a RFP, you must ensure that you evaluate PBM Contestants’ proposed guarantees accurately. To do so, you must:

- Draft your contract before your RFP begins, and make sure you include the proper language in the contract

- Bid out the contract, and require all PBM Contestants to provide all Financial Guarantees based on an exclusion of all errors

- When you provide all PBM Contestants with a sample of claims data, you must make sure that you’ve eliminated all quantity errors from the data

Third: On a regular and ongoing basis, you must monitor your claims data:

- Don’t assume that your PBM is accurately invoicing your health plan

- Also, don’t assume that your PBM is accurately reporting its satisfaction of guarantees

Conclusion

Our review of hundreds of PBM / client contracts reveals that almost none contain the requisite language requiring the PBM to accurately adjudicate claims and reimburse for any errors that occur.

Moreover, our review of the claims data of numerous clients reveals that most PBMs’ adjudication systems are not automatically identifying and correcting or eliminating retail pharmacy errors.

Equally troubling, it’s our understanding that almost no RFPs are taking any of the above matters into consideration when evaluating PBM Contestants’ offers.

The above conclusions mean that (i) most clients are being overcharged for drugs, (ii) most PBMs are misreporting whether they satisfied their contract pricing guarantees, and (iii) most clients who are trying to improve their overall situations are unlikely to do so even after conducting RFPs.

We believe every plan is entitled to be accurately invoiced by its PBM. And every plan is entitled to know that its contract guarantees are being honored. Accordingly, we urge every plan to take the necessary steps to ensure these results.