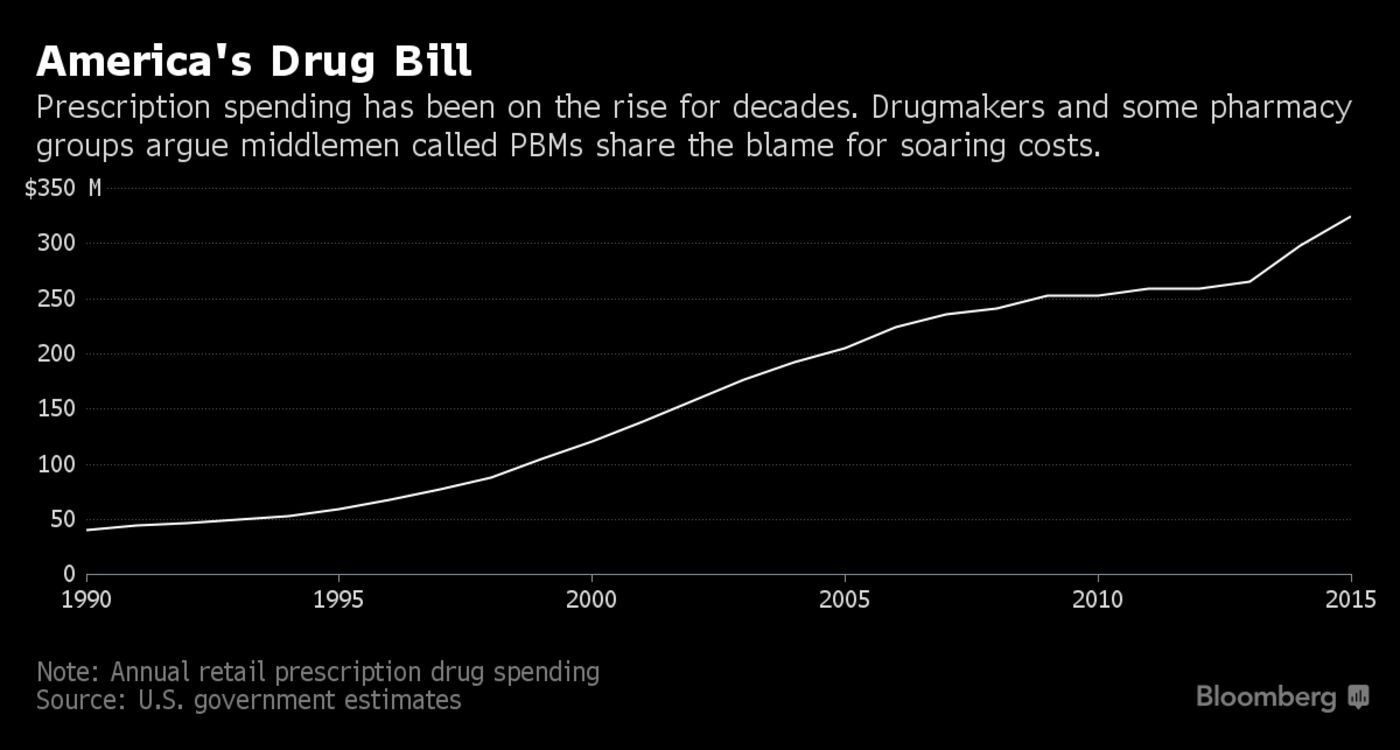

In a decade when the average American’s drug spending has spiraled higher, the figure has fallen at the company. By hiring its own doctors and pharmacists, among other changes, Caterpillar has saved tens of millions of dollars a year. “The model is as successful today as it’s ever been,” says Todd Bisping, a global benefits manager at the company.

Caterpillar’s experiment raises tough questions about a market that President Donald Trump recently slammed for “astronomical” prices. Pharmacy benefit managers process prescriptions for insurers and negotiate with manufacturers on one end and pharmacies on the other. The three biggest—Express Scripts Holding, OptumRx (a unit of insurer UnitedHealth Group), and CVS Health—process about 70 percent of the nation’s prescriptions, according to Pembroke Consulting. Drugmakers, who met with the president behind closed doors in January, have been trying to finger the managers as the culprits of the cost increases. “The drug-pricing system is completely broken,” says Linda Cahn, who runs Pharmacy Benefit Consultants in Morristown, N.J. “For the first time, PBMs are in the crosshairs.”

View Bloomberg Video on Drug Prices here.

The Health Transformation Alliance, a year-old group of more than 30 companies including IBM Corp. and American Express Co., has promised to bring down costs in part by reducing “redundancies and waste in the supply chain.”

PBMs deny raising costs and say pharmaceutical companies seek to mask their own profiteering. “Drugmakers set prices, and we exist to bring those prices down,” Tim Wentworth, Express Scripts’ chief executive officer, said on a Feb. 15 earnings call. Larry Merlo, head of CVS, sounded a similar refrain six days earlier: “Any suggestion that PBMs are causing prices to rise is simply erroneous.”

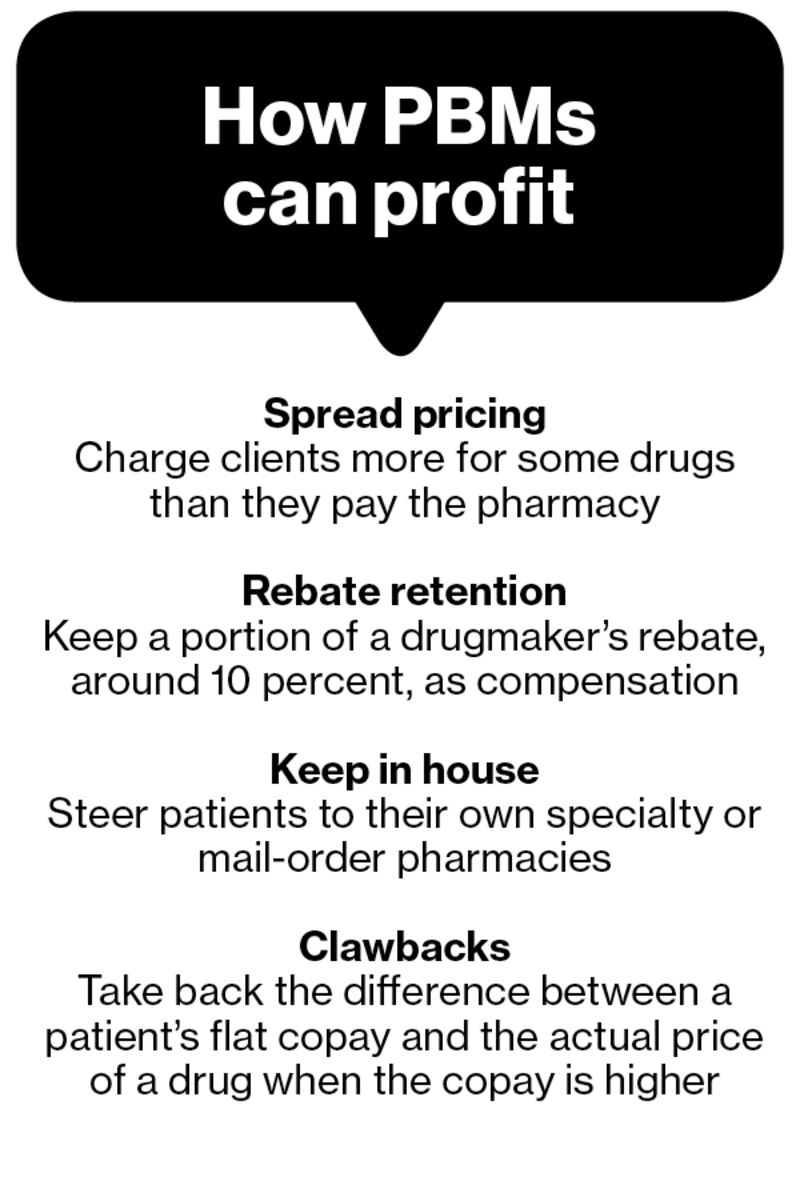

In the U.S., $15 of every $100 spent on brand-name drugs goes to middlemen, estimates Ravi Mehrotra, a partner at MTS Health Partners, a New York investment bank. The largest share, about $8, goes to benefit managers. In other developed countries, only $4 out of every $100 goes to middlemen, he says. PBMs popped up in the late 1960s as payment processors. They now draft medication menus and negotiate prices behind the scenes with drugstores, health plans, and manufacturers.

As their role expanded, so did ways to make money: Benefit managers keep about 10 percent of the rebates from manufacturers vying to get their medicines covered; they sometimes charge health-plan clients more for generics than they reimburse the pharmacies dispensing them; and they channel clients to their own specialty or mail-order pharmacies. PBMs say they vary terms to suit client needs. While the terms are agreed to in contracts, they aren’t always well-understood by clients.

A few benefit managers, including OptumRx, are accused in lawsuits of “clawing back” the difference between a patient’s copay and the actual lower price of a drug from pharmacists. OptumRx owner UnitedHealth Group said the suits are without merit. “Many areas of the PBM industry are just a black box,” says Greg Rucinski, president and founder of Tricast LLC, a Milwaukee company that performs audits for employers.

The industry has had some success. PBMs have forced down costs of hepatitis C medicine sharply over the past two years by pitting competing drugs against one another. For every dollar that managers keep, they save $6 for employers and consumers, according to an analysis sponsored by the Pharmaceutical Care Management Association, their trade group.

Caterpillar’s move away from benefit managers started when it suspected that as much as a quarter of its $150 million drug spending was wasted. The company devised its own list of drugs to offer its U.S. health-plan members and negotiated deals with pharmacies. It promoted generics and discouraged use of expensive heartburn and cholesterol medicines. The changes have saved the company $5 million to $10 million per year on cholesterol-lowering statins alone, Bisping says. Drug spending at Caterpillar, which still uses OptumRx to process claims and obtain rebates, has dropped per patient and per prescription since the company started the program.

Caterpillar offices in Illinois were raided Thursday by federal tax and banking authorities, after years-long U.S. scrutiny of tax practices the company says comply with federal law. Caterpillar said it’s cooperating with investigators.

Some companies are switching to smaller “transparent PBMs” that charge flat fees for processing claims without hidden markups. American Casino & Entertainment Properties LLC, which owns four Nevada gambling houses, says its costs plummeted 28 percent after it dropped its big benefit manager in 2012 in favor of Navitus Health Solutions LLC, according to its general counsel, Phyllis Gilland.

The bottom line: Caterpillar, which reined in its PBM seven years ago, has saved tens of millions of dollars on drug spending.

Original Bloomberg Article found here.

To read other News about our firms, use the Menu at the top of this Page, and click on “News”.