If you missed the latest example of drug manufacturer  abuse, you need to learn about Allergan’s Restasis antics, understand your Plan’s resulting costs, and take action in response.

abuse, you need to learn about Allergan’s Restasis antics, understand your Plan’s resulting costs, and take action in response.

Why? Because you’ll not only save your Plan considerable money by acting on a single drug, you’ll also help teach Allergan a much-needed lesson and discourage other manufacturers from engaging in similar abuses.

A Brief History of Allergan’s Antics

In September 2016, the CEO of Allergan, one of the world’s largest drug manufacturers, made headlines by announcing Allergan was creating a new “social contract with patients“. The CEO pledged that Allergan would limit its annual drug price increases to single digits, and Allergan would commit itself to provide drug “innovation, access and responsible pricing” for all its drugs.

Normally, single digit annual price increases wouldn’t be something to brag about. However, Allergan drew widespread praise given other drug manufacturers’ obscene price increases.

Tellingly, during the subsequent twelve month period, Allergan stuck to its single-digit-price-increase pledge, but did so in a manner that should have caused universal condemnation. Allergan increased the list price of its already-overpriced blockbuster drug Restasis by 9.9%. Unfortunately, almost no one noticed, let alone criticized Allergan for breaching its “social contract” to provide “responsible pricing” for all its drugs.

However, on September 8, 2017, Allergan engaged in conduct that did result in criticism: Allergan announced that it had entered into a deal to sell its patent rights on Restasis to the St. Regis Mohawk Indian Tribe. Experts quickly understood that Allergan’s deal might enable Allergan to delay generic competition for Restasis, since generic manufacturers might be unable to challenge Allergan’s Restasis patents given the Indian Tribe’s sovereign immunity.

Allergen’s deal likely represents a big win for Allergan, a smaller win for the Indian Tribe, and significant increased costs for all who pay for Restasis. Assuming Allergan is able to preclude generic competition for Restasis until 2024 –

- Allergan is likely to make an additional $13.4 billion in net revenue

- The Indian Tribe will realize $13.75 million upon execution of the contract, and approximately $15 million annually in royalties

- But plans, consumers and government entities in the United States will spend an additional $10.7 billion in total costs. (1)

A Brief Background on Restasis

Restasis was approved by the FDA in 2003 as a treatment for dry eyes. However, as is typically the case, the drug was not tested against existing treatments and shown to be more effective or with fewer side effects.

Moreover, in the four clinical studies submitted to the FDA to gain approval, the evidence on Restasis’ efficacy was weak: After using Restasis for six months, only 15% of the tested 1,200 individuals experienced wetter eyes, as opposed to 5% using a placebo. In addition, while 15% showed improved tear production, 17% experienced ocular burning while using Restasis.

Also, the active compound in Restasis is cyclosporine, a drug that was originally investigated and approved to suppress the immune system for organ transplants. Although Allergan’s submitted trials did not tally up the adverse events associated with immune suppression, Allergan did report 1% to 5% each of a number of infections including pruritus, conjunctival hyperemia, and discharge.

Despite Restasis’ weak therapeutic showing and side effects, Allergan listed its new product at a high price and repeatedly raised the drug’s price over the years. Today, a 30 day Restasis prescription for just one individual typically costs a Plan approximately $380. As a result, Restasis is Allergan’s second best-selling drug after Botox, with global sales last year of $1.5 billion.

But here’s the truly shocking part of this story: There are many over-the-counter treatments for dry eye that your plan beneficiaries could instead be purchasing for just a few dollars, including Clear Eyes, Opti-Free Rewetting Drops, Refresh, Soothe, Systane, Tears Again and Visine Tears. Walk into any pharmacy and you’ll see them lined up on the shelf. Dry eye treatments are also easily purchased at very low cost from Amazon.

With weak therapeutic evidence, notable side effects and multiple alternative lower-cost treatments available, how did Restasis become a blockbuster drug? The simple answer: Marketing.

For years, Allergan has run extensive advertisements for Restasis inducing plan beneficiaries – like yours – to use Restasis. If you want to pause for a moment and see Allergan’s clever ads, watch here and here.

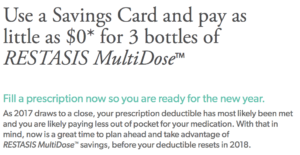

Allergen also incentivizes Restasis use by offering plan beneficiaries a coupon to eliminate their deductible and copayment costs. Here’s a snapshot of Allergan’s current coupon and accompanying website exhortation to buy more Restasis “for $0”:

Your Plan’s Likely Costs for Restasis

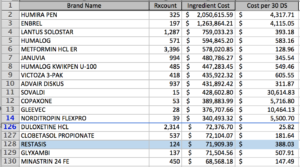

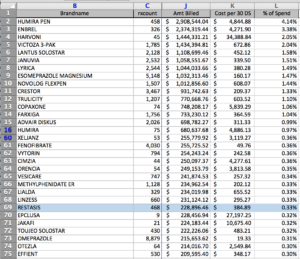

While Allergan is busy providing ways for your plan beneficiaries to end-run your deductible and copayment structure, it’s likely your Plan is spending a small fortune on Restasis. Below are two “high-to-low cost” claims data analyses that our firm generated recently for two new clients that came to our firm, reflecting each of the Plan’s most expensive to least expensive drugs by total annual Plan costs.

As reflected below, one Plan that had an existing contract with Express Scripts and total annual costs of approximately $39 million had spent $71,909 annually for 124 scripts of Restasis:

Another Plan that had an existing contract with Caremark and total annual costs of approximately $70 million had spent $228,896 annually for 468 scripts of Restasis:

No Plan should spend such large amounts for Restasis, especially because virtually all plan beneficiaries can purchase over-the-counter treatments for dry eyes for only a few dollars.

What Should Your Plan Do

As a plan administrator, your first step should be to determine the amounts your Plan is spending on Restasis. If you need help doing so, our firm can run a “high to low cost” claims data analysis quickly and inexpensively and provide important information about Restasis, as well as many other drugs on which your Plan should take action.

When you analyze your claims data, it’s almost certain you’ll discover your Plan is spending large amounts on Restasis. That’s especially true, because most PBMs continue to include Restasis on their standard Formularies and do nothing to control its use. For example, both Express Scripts and Caremark included Restasis on their 2017 standard Formularies. See Express Scripts and Caremark 2017 Formularies. Moreover, if your Plan intends to rely on either of those two PBMs’ standard Formularies in 2018, you’ll continue to squander large amounts on Restasis since neither PBM is excluding Restasis in 2018. See Express Scripts’ 2018 Formulary and Caremark’s 2018 Formulary.

Assuming you discover your Plan is incurring large costs for Restasis, you have two choices to steer your Plan Beneficiaries to use over-the-counter dry eye treatments instead. First, you can impose a customized Prior Authorization that requires your plan beneficiaries to try – and fail – at least two other dry eye treatments before they can obtain Restasis. Here’s a customized Prior Authorization you can use that establishes those criteria. Second, you can block Restasis coverage, and allow limited medical exceptions based on the same criteria identified in our customized Prior Authorization. Note that blocking coverage may be your only approach if your existing PBM contract requires your Plan to rely on your PBM’s standard Prior Authorization programs. Blocking coverage may also make more sense, since many PBMs simply rubber-stamp approvals and will fail to ensure that your customized Prior Authorization criteria are actually satisfied.

Regardless of which approach you implement, your PBM may indicate you will lose rebates if you implement a customized Prior Authorization or block Restasis coverage. However, assuming your PBM only reduces your rebates by the same amounts that your PBM was actually collecting and passing through in Restasis rebates, your Plan will come out ahead. Why? Because if you entirely – or largely – eliminate Restasis scripts, you’ll clearly save far more than you lose in Restasis rebates.

To determine if your PBM reduces your rebates appropriately, you should try to obtain information from your PBM on the actual amount of Restasis rebates that your PBM was collecting and passing through to your Plan. Unfortunately, it’s almost certain that your PBM contract does not require that your PBM provide such information. Accordingly, if your PBM won’t do so – and you don’t trust that your PBM has appropriately reduced your rebates – you should consider filing an accounting proceeding. We’ve written before about why an accounting proceeding will be useful, and explained how your Plan can file such a proceeding at little or no cost.

Bottom line: It’s time for your Plan to pay attention to Allergan’s recent activities and take action on Restasis. You’ll reduce your costs significantly, and you’ll communicate to Allergan and other manufacturers that the marketplace will no longer tolerate manufacturers’ marketplace wrongdoing.

# # #

To read other RxAlerts providing recommendations for decreasing and controlling your Plan’s prescription coverage costs, go to the Menu Bar, and click on RxAlerts.

Footnotes

1. See Silverman, Ed, “The U.S. would pay an extra $10.7 billion without generic Allergan drug”at https://www.statnews.com/pharmalot/2017/10/02/allergan-restasis-patents-mohawks/.